Sales tax software

for

Accountants

Automate your clients sales tax registrations, filings, exemptions and international compliance with one tool.

"We partnered with Kintsugi so our customers can proactively track tax nexus and avoid surprises. Building the integration was fast and frustration-free thanks to their APIs and responsive team.

"Kintsugi really does take care of everything once your accounts are synced. It automatically calculates and breaks down sales tax by platform and state."

80%

reduction in compliance time

"We were drowning in tax compliance before Kintsugi. Their automation took over the entire process—tracking different rates, managing exemptions—it was a game changer for us."

90%

time savings on compliance

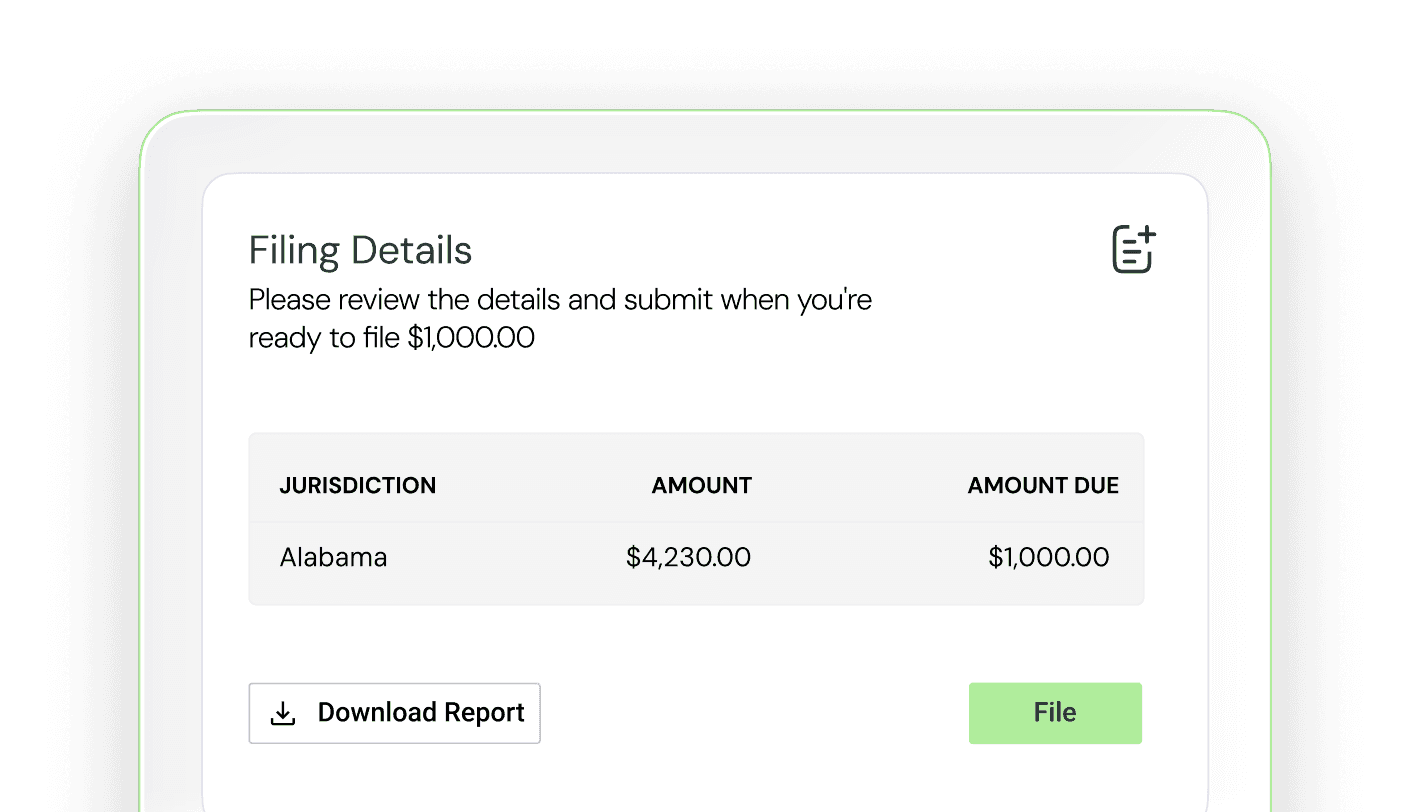

Sales tax automation built for accounting workflows

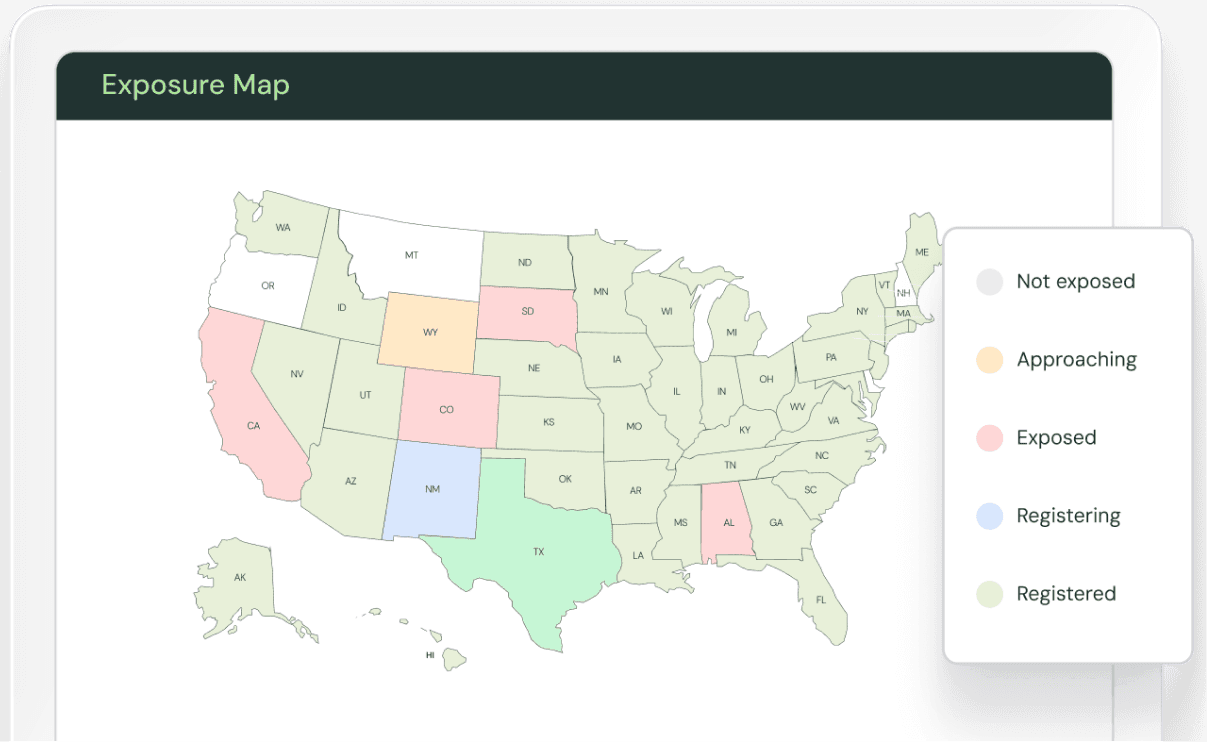

Nexus monitoring

Track economic and physical nexus across all states. See your exposure clearly. Register before problems arise, not after notices arrive.

Historical compliance resolution

Exemption certificate management

Notice management

International capabilities

Spend less time and money on sales tax with Kintsugi

5,100+

businesses automated

$13.5B

transactions processed

<2 hours

average support response

Why accounting firms choose Kintsugi

Designed for modern accounting practices

Focus on higher-value work

Automate routine compliance tasks. Spend more time on tax planning, advisory services, and growing your practice.

Predictable pricing

$75 per filing or registration. No per-transaction fees that punish client growth.

True automation

Complete automation from nexus monitoring through filing and remittance. Reduce manual work dramatically.

Expert support included

Tax professionals on staff who understand multi-state complexity. Real support when you need guidance on client situations.

Transform how you handle sales tax for clients

FAQs

What is the best sales tax software for accountants?

For automated multi-client management, Kintsugi offers extensive integrations, no annual commitments, and complete automation from calculations through filing. Avalara serves large enterprises but requires significant investment. The best choice depends on your client mix and automation needs.

What software is used to keep track of sales tax?

Specialized sales tax software like Kintsugi handles the complete compliance workflow: nexus monitoring, calculations, filing, and remittance. General accounting software (QuickBooks, Xero) tracks collections but lacks comprehensive compliance features.

Which accounting software handles sales tax best?

While QuickBooks and Xero offer basic sales tax tracking, they don't provide multi-state filing, nexus monitoring, or automated compliance. Best practice is integrating your accounting software with dedicated sales tax automation like Kintsugi.

How does Kintsugi pricing work for accountants?

$75 per filing or registration with no annual commitments. No per-transaction fees regardless of client sales volume. All integrations and support included. Transparent pricing you can easily pass through to clients.

Can multiple team members access the platform?

Yes. Set up appropriate access for your team members to manage different clients and functions within the platform.

What makes Kintsugi different for accounting firms?

True end-to-end automation (not just calculations), extensive integration capabilities, no annual contracts, and a platform that scales efficiently as you add clients. Plus responsive support from actual tax professionals.

Still have questions?