Sales tax filing software that helps you file in every state, every time

Kintsugi files automatically in every state where you have nexus. Automatic preparation, submission, and remittance. Every deadline met, every format correct, every payment confirmed.

Join 5,100+ businesses who've already made the switch

Built for how ecommerce actually works

All your channels connected

Shopify, Amazon, Etsy, your custom store; all channels flow into one unified tax system. Real-time calculations for every SKU, every variant, every jurisdiction.

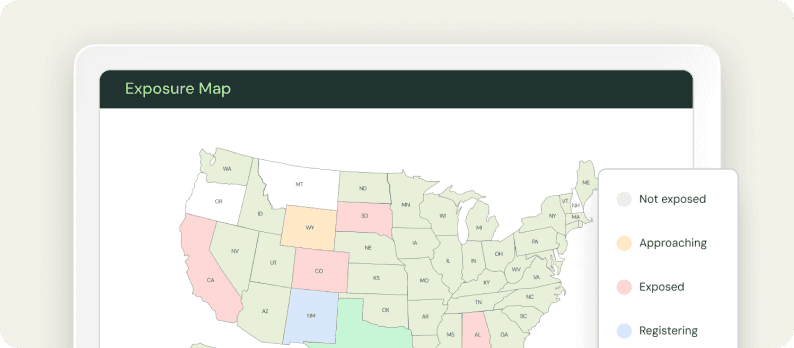

Real-time nexus monitoring

See exactly where you have exposure before states come knocking. Get alerts when you're approaching thresholds. Register when you're ready, not when you're panicked.

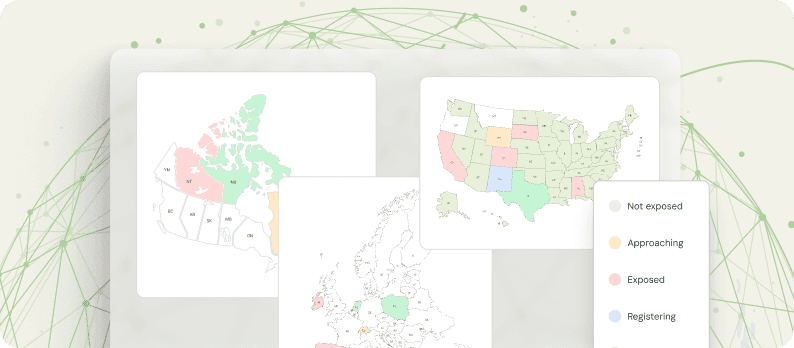

Cross-border ready

Selling internationally? Same simple experience for VAT, GST, and sales tax. 40+ countries supported with automatic currency conversion and local compliance.

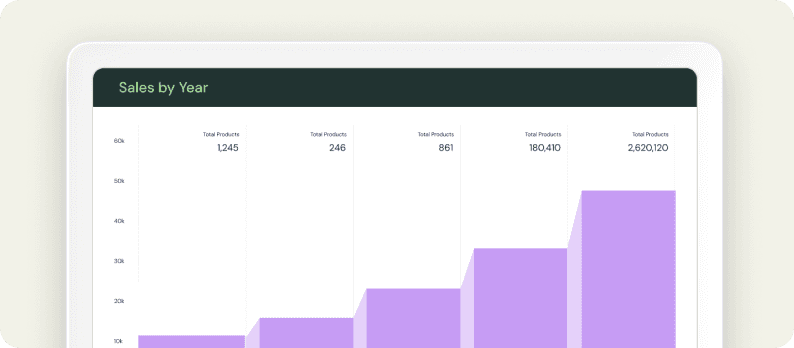

Built for your catalog

Whether you sell 10 SKUs or 10,000, physical goods or digital downloads, or wholesale; we handle the nuances. Product taxability rules applied automatically.

Built for your catalog

Whether you sell 10 SKUs or 10,000, physical goods or digital downloads, or wholesale; we handle the nuances. Product taxability rules applied automatically.

Spend less time and money on sales tax with Kintsugi

5,100+

businesses automated

$13.5B

transactions processed

<2 hours

average support response

Beyond calculations and filing

Find out which states you should be filing in.

No credit card required.

For businesses ready to stop managing deadlines

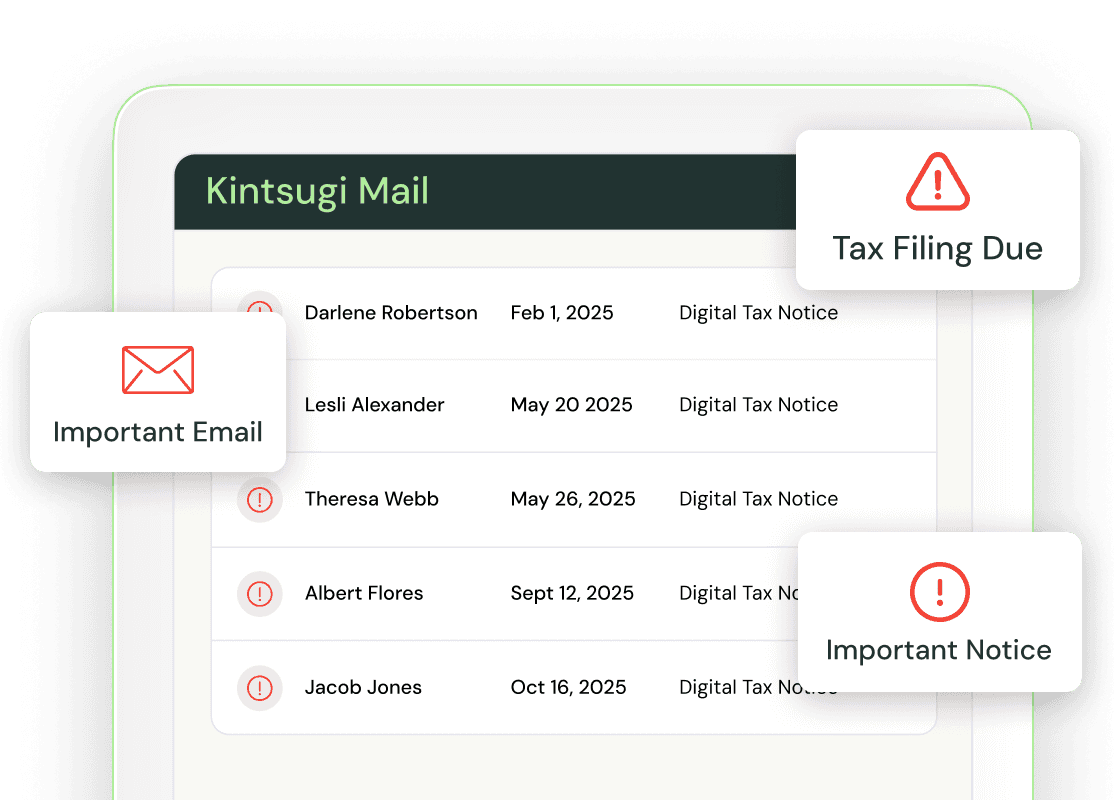

See problems before they're problems

Upcoming deadlines visible months out. Automatic alerts before due dates. Fix issues before they become penalties.

Predictable pricing

$75 per filing or registration. No per-transaction fees that punish client growth.

Keep your current setup

Already using QuickBooks? Shopify? Stripe? Perfect. Kintsugi connects to what you have.

Expert support included

Our support team has filed in every state. They know the quirks, the edge cases, the random requirements.

Get free help filing sales tax with Kintsugi

FAQs

Does QuickBooks handle sales tax filing?

QuickBooks calculates tax and tracks what you collect, but doesn't file returns or send payments to states. You need separate filing software (like Kintsugi) or manual filing. We integrate directly with QuickBooks for seamless automation.

What's the best software for small business tax filing?

For sales tax: Kintsugi if you want actual automation across multiple states. TaxJar works but requires more manual work. Avalara is overkill unless you're enterprise. For income tax, that's completely different (TurboTax Business or a good CPA).

What mistakes do businesses make with sales tax filing?

The expensive ones: missing deadlines (instant penalties), wrong filing frequency, forgetting local jurisdictions, not filing zero-returns when required, missing amended returns after refunds. Software eliminates these completely.

How do businesses actually handle sales tax?

Register where you have nexus. Calculate tax at checkout. Collect from customers. File returns on schedule. Pay states by deadline. Most businesses struggle with steps 4 and 5, which is exactly what Kintsugi automates.

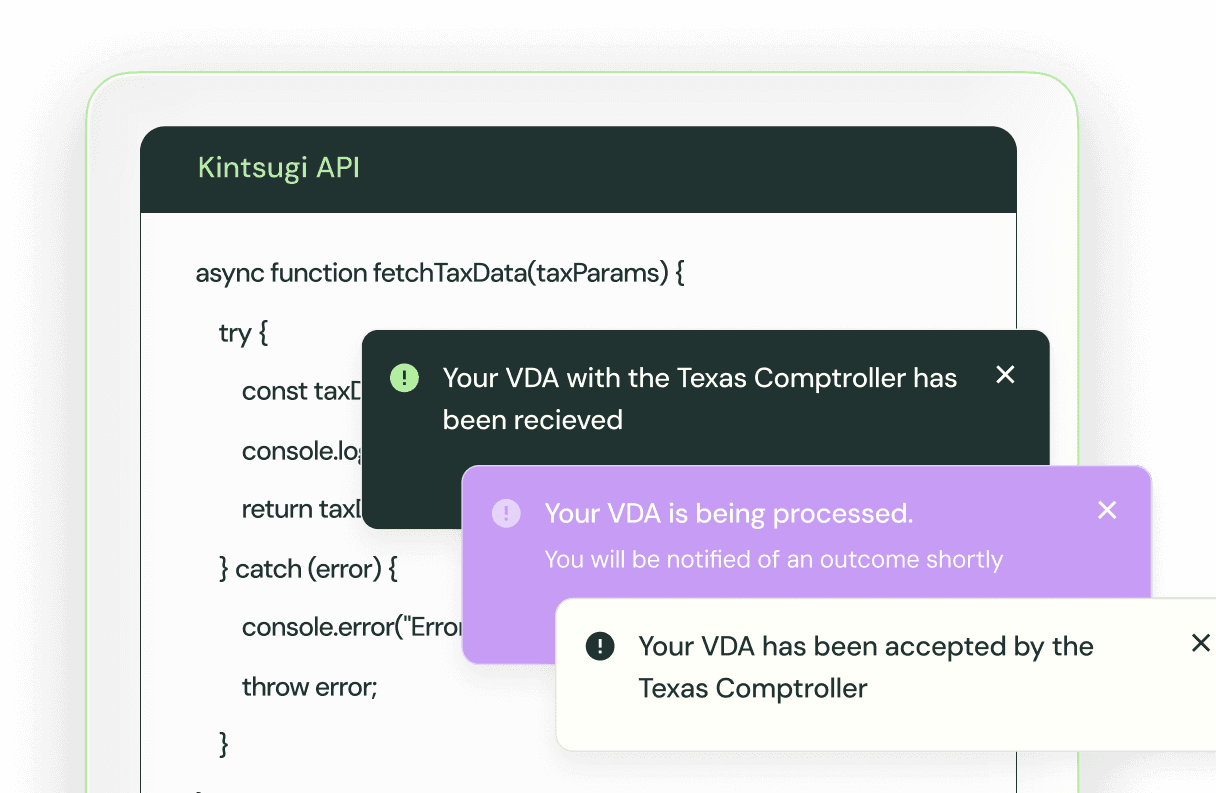

How does Kintsugi's automation work specifically?

Your sales data flows in automatically from connected platforms. We calculate what you owe each state. When deadlines approach, returns get prepared and filed electronically. Payments go out via ACH. You get a summary showing everything's done.

What about amended returns?

We handle them. Whether you're correcting errors, processing refunds, or applying credits, amendments get filed properly without messing up your regular schedule.

Can you handle home rule states?

Yes. Colorado with its hundreds of local taxes. Louisiana with parish filing. Alaska with borough requirements. These complex states work exactly like simple ones in our system.

Still have questions?