Sales tax compliance platform trusted by 5,100+ businesses

Physical stores, online channels, B2B sales, and marketplaces. Kintsugi manages sales tax compliance across every way you sell, in every place you sell.

Join 5,100+ businesses who've already made the switch

Complete sales tax compliance coverage

Nexus monitoring

Track economic and physical nexus across all states. See your exposure clearly. Register before problems arise, not after notices arrive.

Registration management

Automatic filing & remittance

All your channels connected

Audit defense ready

The proof is in the numbers

5,100+

businesses automated

$13.5B

transactions processed

50

states in

the US

100+

countries

supported

<2 hours

average support response

Beyond calculations and filing

Exemption management

Notice response

Back tax resolution

International compliance

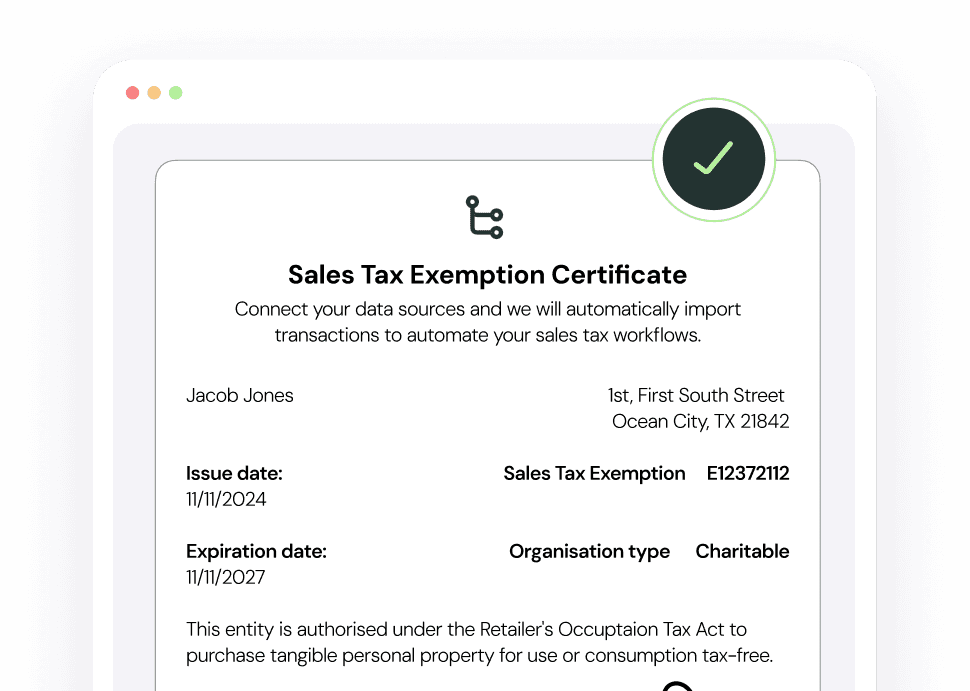

Exemption management

Store and validate every certificate. Track expiration dates. Apply exemptions automatically. Audit-ready documentation always available.

No credit card required.

For businesses that can't afford compliance failure

Sales tax experts on staff

CPAs and sales tax professionals on staff. They've handled every sales tax compliance scenario, filed in every state. Real humans who answer when you need them.

Technology that scales

From your first nexus state to nationwide sales tax to global sales tax compliance. One platform that grows with you without growing complexity.

Expand channels instantly

Adding TikTok Shop? Launching on Walmart.com? Testing a new marketplace? Connect once and stay compliant everywhere.

Transparent pricing

Predictable monthly fee. Every integration included. The only sales tax compliance solution that gets cheaper as you grow.

FAQs

What triggers sales tax compliance requirements?

Physical presence (office, employees, inventory) or economic nexus (typically $100,000 in sales or 200 transactions per state). Each state has different thresholds

What is the best software to use for sales taxes?

For sales tax specifically: Kintsugi for multi-channel sellers who want true automation; Avalara for Fortune 500 companies with complex international needs; Vertex for enterprises with existing ERPs.

What does compliance cost with Kintsugi?

$75 per filing or registration, or fixed monthly plans for higher volume. No per-transaction fees. Free compliance assessment to start.

What happens if I ignore sales tax compliance?

States are getting aggressive. They're buying transaction data, hiring auditors, and sharing information. When they find you—and they will—you'll owe back taxes, penalties, and interest for every year you weren't compliant.

Why can't my accountant handle sales tax compliance?

They can file returns, but can they track nexus across 45 states? Calculate rates for 13,000 jurisdictions? Manage exemption certificates? Most CPAs refer sales tax compliance to specialists—like us.

We're already non-compliant. Is it too late?

No. Voluntary disclosure always beats involuntary discovery. We handle VDAs regularly, often reducing penalties by 75% or more. The sooner you address sales tax compliance, the better your outcome.

How is Kintsugi different from TaxJar or Avalara?

We automate everything, not just calculations. While they focus on enterprise complexity, we focus on actual automation. Connect once, stay compliant forever. No modules, add-ons, or implementation consultants required.

Still have questions?