Shopify, Amazon, TikTok Shop, and beyond. Kintsugi handles sales tax compliance across every channel, marketplace, and country you sell in.

Get a demo

Try free →

Join 5,100+ businesses who've already made the switch

Built for how ecommerce actually works

All your channels connected

Shopify, Amazon, Etsy, your custom store; all channels flow into one unified tax system. Real-time calculations for every SKU, every variant, every jurisdiction.

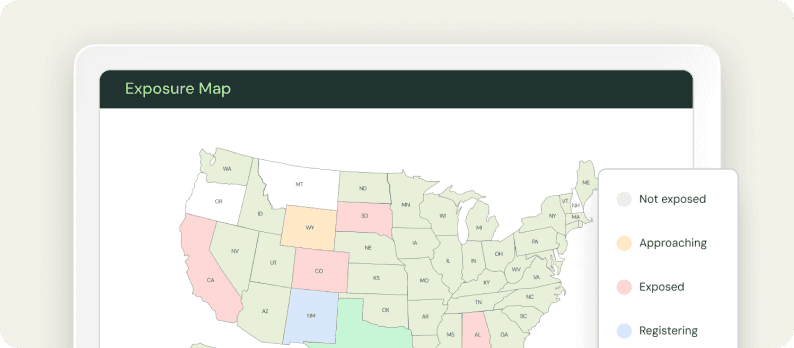

Real-time nexus monitoring

See exactly where you have exposure before states come knocking. Get alerts when you're approaching thresholds. Register when you're ready, not when you're panicked.

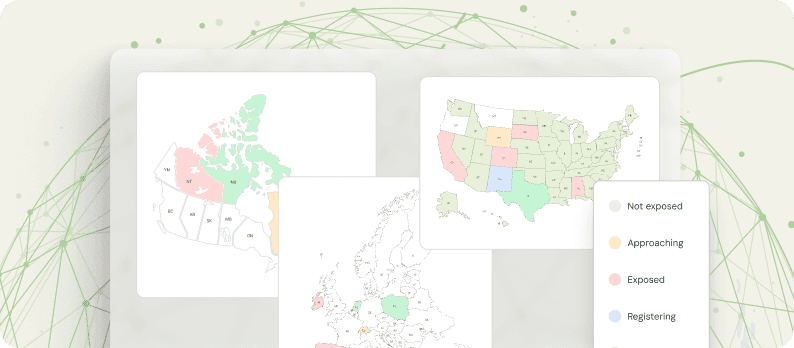

Cross-border ready

Selling internationally? Same simple experience for VAT, GST, and sales tax. 40+ countries supported with automatic currency conversion and local compliance.

Built for your catalog

Whether you sell 10 SKUs or 10,000, physical goods or digital downloads, or wholesale; we handle the nuances. Product taxability rules applied automatically.

Built for your catalog

Whether you sell 10 SKUs or 10,000, physical goods or digital downloads, or wholesale; we handle the nuances. Product taxability rules applied automatically.

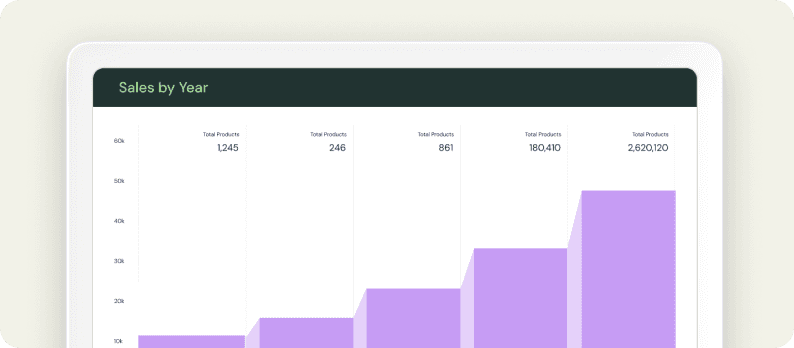

The proof is in the numbers

5,100+

businesses automated

$13.5B

transactions processed

50

states in

the US

100+

countries

supported

<2 hours

average support response

No credit card required.

Built for ecommerce businesses who move fast

Expand channels instantly

Adding TikTok Shop? Launching on Walmart.com? Testing a new marketplace? Connect once and stay compliant everywhere.

Pricing that makes sense

Predictable monthly fee. Every integration included. The only sales tax solution that gets cheaper as you grow.

Support from ecommerce tax experts

Our team has handled every edge case: bundles, subscriptions, digital goods, international shipping. They understand ecommerce.

Integrations that actually work

Native connections to Shopify, WooCommerce, BigCommerce, and major marketplaces. Set up in minutes, not months.

FAQs

What ecommerce platforms does Kintsugi support?

Shopify, Amazon, Etsy, eBay, Square, WooCommerce, BigCommerce, TikTok Shop, and more. Plus custom API support for proprietary platforms. Everything syncs automatically.

How does Kintsugi handle marketplace facilitator laws?

We automatically track which marketplaces collect tax on your behalf and which require you to collect. No double taxation, no gaps in coverage. Marketplace sales still count toward nexus thresholds where applicable.

Can you handle high-volume sellers?

Absolutely. Fixed monthly rates based on filing frequency, not transaction volume. The more you sell, the lower your per-filing cost becomes. Custom pricing available for enterprise sellers.

What if we sell on platforms you don't integrate with?

Our API handles any platform. If you can export your sales data, we can automate your compliance. Custom integrations available for enterprise clients.

How does pricing work?

$75 per filing or registration. No per-transaction fees. Fixed-rate plans available for high-volume sellers. Free to connect and see your tax liability.

How do I collect sales tax for ecommerce?

Register in states where you have nexus → Configure tax collection at checkout → File returns quarterly → Remit payments on time. Kintsugi automates this entire process.

Which sales tax software should I use?

For multi-channel sellers: Kintsugi (full automation, no per-transaction fees). For Stripe-only: Stripe Tax. For basic calculations only: TaxJar. For enterprise: Avalara (expensive but comprehensive).

Can Shopify handle my sales tax?

Shopify calculates tax at checkout but doesn't file returns or track nexus. You'll need additional software for complete compliance.

Still have questions?