Avalara

vs

TaxJar

Avalara offers businesses tax automation with nearly 1,200 integrations, but comes with complex pricing, long implementation, and limited liability protection. TaxJar provides a simple setup for US sellers, but lacks global coverage and a ton of crucial features. Let's deep dive into Avalara vs. TaxJar to decide which platform best suits your needs.

Avalara and TaxJar Compared

Avalara is established in the market, but comes with complexity that modern businesses don't need - hidden fees, lengthy setup, and you still own the liability.

Based on customer reviews, setup can take weeks to months with lack of customer support during implementation.

Costs range from $21,000 to $160,000 annually, plus $14,500 implementation fees. Extra charges for each state filing and VAT registration.

Existing customers report that support is nearly non-existent. Calls result in tickets that apparently go nowhere, with no follow-up or resolution.

Customer reviews describe predatory contract practices, with businesses feeling misled and trapped in agreements that are difficult to exit.

Vast-Association8113

Horrible employees, horrible service, horrible value for the dollar. Predatory business practices. They lie, mislead, and use any tactic to trap you in the contract. avoid at all costs! There are many significantly less expensive and better options out there.

LIAPHX

Don't do it! Avatax is TERRIBLE. Implementation is bitch. Support is horrible. Managed returns are a joke - they've done our returns incorrectly despite asking them to correct (obvious) categories and now we have to amend multiple states and they are trying to charge us (this is an onboarding issue they need to fix.) They cant do NM and HI sourcing correctly. Had to set up custom rules which they agreed with. Without any knowledge of sales tax laws, you wouldn't know, but they are seriously fucking things up. DONT DO IT.

'Don't use this software'

★

★

☆

☆

☆

2.0

Not good. Attempted to cancel, but had to jump through hoops and we are still being charged monthly. We had multiple changes in our dedicated support rep, and he would constantly cancel our scheduled meetings.

⊕

Pros

Initially I thought Avalara was nice because it would calculate taxes on our behalf, then I realized the taxes calculated were wrong.

⊖

Cons

Customer Support was horrendous and slow. Platform was difficult to navigate at times and it is overpriced.

Vast-Association8113

Horrible employees, horrible service, horrible value for the dollar. Predatory business practices. They lie, mislead, and use any tactic to trap you in the contract. avoid at all costs! There are many significantly less expensive and better options out there.

LIAPHX

Don't do it! Avatax is TERRIBLE. Implementation is bitch. Support is horrible. Managed returns are a joke - they've done our returns incorrectly despite asking them to correct (obvious) categories and now we have to amend multiple states and they are trying to charge us (this is an onboarding issue they need to fix.) They cant do NM and HI sourcing correctly. Had to set up custom rules which they agreed with. Without any knowledge of sales tax laws, you wouldn't know, but they are seriously fucking things up. DONT DO IT.

'Don't use this software'

★

★

☆

☆

☆

2.0

Not good. Attempted to cancel, but had to jump through hoops and we are still being charged monthly. We had multiple changes in our dedicated support rep, and he would constantly cancel our scheduled meetings.

⊕

Pros

Initially I thought Avalara was nice because it would calculate taxes on our behalf, then I realized the taxes calculated were wrong.

⊖

Cons

Customer Support was horrendous and slow. Platform was difficult to navigate at times and it is overpriced.

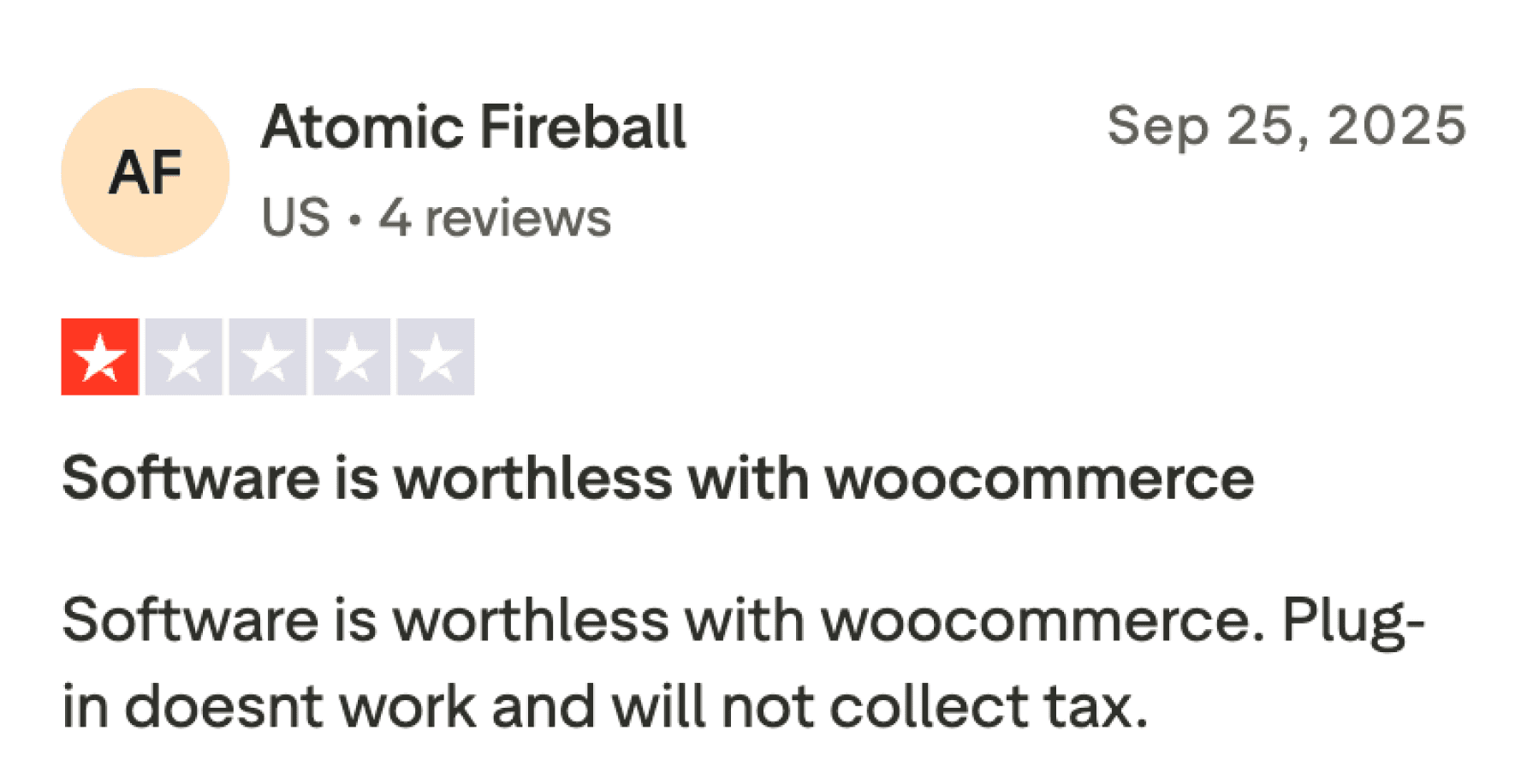

TaxJar works well for US ecommerce but falls short on global expansion. Modern businesses need comprehensive international coverage and advanced automation.

TaxJar automates tax processes in the US but doesn't support Asia, South America, Africa, and Oceania - a dealbreaker for international growth.

Direct integrations with Shopify, WooCommerce, and Amazon, but lacks connectivity with systems like SAP, Oracle, or advanced NetSuite workflows that enterprises need.

While faster than Avalara, TaxJar states "Simple onboarding accelerates the time it takes to get up and running (typically within 7 days)."

No virtual mailbox for tax notices, no automated certificate renewal alerts, and limited AI-powered features compared to modern platforms.

Avalara vs. TaxJar vs. Kintsugi

Why growing businesses choose Kintsugi

Kintsugi was built for how modern businesses actually operate. Get real-time visibility, predictable costs, and automation that works without constant developer maintenance.

Transparent Pricing

No hidden fees or surprises. Clear pricing with no onboarding or implementation fees. Plan tiers based on filing volume or custom quotes for enterprise needs.

Complete Global Coverage

Unlike TaxJar's US-only focus, Kintsugi handles multi-state US compliance plus international VAT and GST across all continents.

AI-Powered Automation

Powered by Vertex, Kintsugi uses AI-driven technology for intelligent tax automation, real-time nexus monitoring, and automatic product classification.

Fast, Easy Setup

No-code setup to sync your sales platform. Get started in hours, not months, with dedicated onboarding assistance and responsive support.

Seamless Integrations

No-code setup with Shopify, Stripe, Chargebee, QuickBooks, and NetSuite. No integration nightmares or hidden consulting costs

Responsive Customer Support

Priority implementation and dedicated success management - not the "tickets that go nowhere" that Avalara customers report.

Avalara vs. TaxJar vs. Kintsugi

See how Kintsugi leads the way when comparing to players like Avalara and TaxJar

Filing & Reporting

Automated filing and reporting dashboards

Automated sales tax reporting and filing through AutoFile

Reports and filing-ready exports

Global Coverage

US and EU (extra fees), calculation-only outside these regions

US only; doesn't support Asia, South America, Africa, Oceania

Multi-state and international jurisdictions (US, global VAT, GST)

High Transaction Volume

Enterprise-level

High-volume sellers on Shopify Plus, Amazon, ERP systems

Real-time computation for millions of transactions per hour

Advanced Reporting

Avalara Insights analytics dashboards

Reporting dashboard shows sales tax collected, owed, and filed by jurisdiction

Finance dashboards with real-time tax liability monitoring

Support & SLAs

Tickets that "go nowhere" per customer reviews

Premium plans include enhanced support SLAs and dedicated account manager

Priority implementation and dedicated success management

Security & Compliance

SOC 2 Type II, ISO 27001,

role-based access

No proof of SOC 2 or advanced security certifications

SOC 2 Type II, GDPR, role-based access

Error Insurance

Not available

Not available

Yes, up to total amount paid

Virtual Mailbox

Not available

Not available

Yes (Kintsugi Mail)

Tax Liability

You own it

You own it

Error insurance included

Pricing Transparency

Complex, requires sales contact ($21K-$160K/year)

Premium plans available, requires contact for details

Transparent, no hidden fees

Implementation Fees

$14,500 one-time cost

No explicit implementation fees mentioned

No implementation fees

State Filing Fees

$42-$54 per filing + $25-$475 activation fee

Included in AutoFile pricing

Included in plan tiers

Nexus Monitoring

Economic nexus tracking available

Multi-state tax compliance and automated jurisdiction filing

Real-time nexus monitoring with alerts

Certificate Management

Exemption certificate management available

Exempt non-taxable products via built-in sales tax categories

Alerts when certificates need renewal

Easy Onboarding

Setup takes weeks to months (per customer reviews)

Typically within 7 days

No-code setup, get started quickly

Tax Calculation

Real-time at point of sale

Real-time through TaxJar API

Automated real-time calculations

Platform Integrations

1,200+ (Shopify, NetSuite, SAP, Oracle, QuickBooks)

Shopify, WooCommerce, Amazon, QuickBooks

Shopify, Stripe, Chargebee, QuickBooks, NetSuite