Table of contents

Top Fractional CFO Companies

This is a guest blog post from our partner, Zeni. It shares their perspective on things you should consider when evaluating your options, but is not an exhaustive list of all the fractional CFO services available.

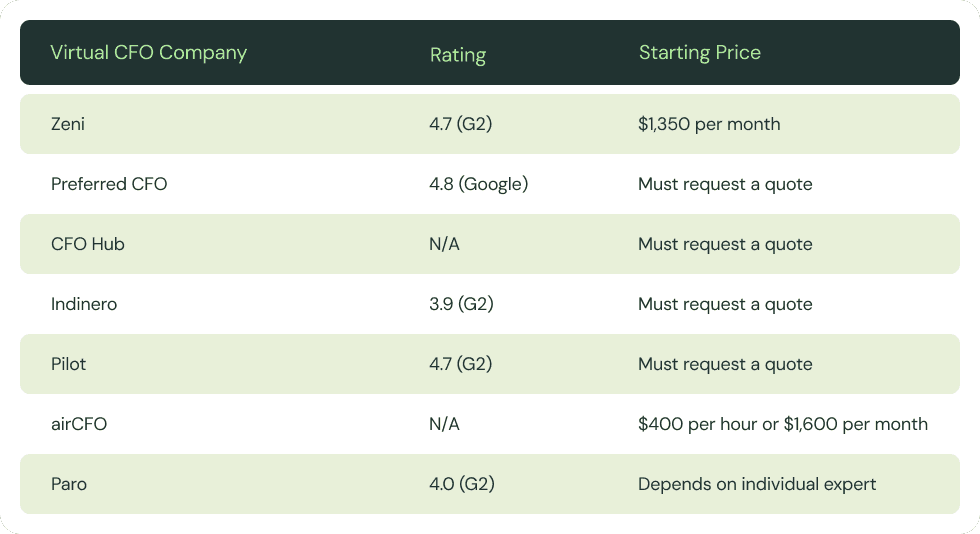

Fractional CFOs provide expert financial support on demand, making them a flexible alternative to a full-time CFO. Some of the best fractional CFO companies include Zeni, Preferred CFO, Indinero, and Pilot.

Fractional CFO Companies Compared

1. Zeni

Zeni is a financial management platform meant to give businesses everything they need to grow, including fractional CFO services. The platform specializes in supporting companies from the seed stage through Series C and beyond. Zeni also supports non-VC-backed companies, from ecommerce to professional services, and beyond.

As a result, Zeni’s CFO guidance is ideal for founders navigating financial challenges, like financial modeling, fundraising, and investor relations. However, their financial expertise also extends to many other areas, including:

Business planning and entity structuring

Financial reporting and compliance

Budgeting and cash flow management

Strategic planning and risk management

Mergers and acquisitions (M&A)

Whatever CFO advisory services you need, Zeni charges a flat monthly fee rather than an hourly rate, making costs easy to predict. Here’s how the subscriptions work:

CFO Starter: $1,500 per month (or $1,350 when billed annually) with a one-time $2,000 setup fee. This plan includes annual budgeting, budget vs. actual analysis, and 12-month cash flow forecasting.

CFO Growth: $2,900 per month (or $2,610 when billed annually) with a $6,000 setup fee. This tier adds financial modeling, scenario planning, and key performance indicator (KPI) tracking.

CFO Enterprise: Custom pricing for companies that need more advanced or specialized CFO support. You can pick and choose from the services above.

Beyond CFO advisory, Zeni also provides a complete suite of financial services—including bookkeeping, payroll, and business tax management—along with built-in products like bill pay software and a business credit card.

All of these tools are integrated into a single dashboard that leverages AI to minimize manual work. For example, Zeni’s AI CFO Agent can automate complex tasks like runway projections and strategic planning.

2. Preferred CFO

Preferred CFO is a business consulting firm that specializes in fractional CFO services. Instead of offering fixed subscriptions, it provides highly customizable engagements, including options for full-time, part-time, or one-off assistance.

This makes Preferred CFO a compelling option if your advisory needs vary from month to month, allowing you to pay for only the help you need. Speaking of, the firm also offers a wide range of CFO services, such as:

M&A

Financial forecasting

Cash flow management

Financial operations optimization

Financial reporting and GAAP accounting

Inventory management and internal controls

That said, Preferred CFO focuses on a handful of specific services. These include serving as a financial controller, setting up integrated financial systems, and raising debt or equity capital. It also has unique expertise with startups in the SaaS industry.

In addition to strategic financial guidance, Preferred CFO offers human resources (HR) support. This service is similarly flexible, providing assistance with processes like recruiting and onboarding, payroll and benefits administration, and policy development.

3. CFO Hub

CFO Hub is another consulting firm that offers fractional CFO services. Unlike many of the other entries on this list, it has physical offices in several cities, including San Diego, Orange County, Los Angeles, San Francisco, New York, Austin, and Washington, DC.

As a result, they might be a compelling option if you live near one of their locations and would enjoy meeting with your fractional CFO face to face. In that case, here are the specific services you can expect CFO Hub to offer:

Financial strategy: Develop financial roadmaps, identify growth opportunities, and track KPIs.

Budgeting and forecasting: Build baseline financial projections, forecasting models, departmental budget frameworks, and scenario planning tools.

Financial modeling: Construct financial models and decision-making tools to inform cash flow projections, unit economics, valuation, and analysis .

Capital raise support: Prepare you for capital events by developing financial narratives, investor presentations, and due diligence materials.

Risk management: Strategically assess financial risks and implement internal controls to mitigate them. - Compliance support: Establish compliance frameworks that meet regulatory requirements across jurisdictions.

Exit and M&A guidance: End-to-end transaction support through initial public offerings (IPOs), successions, and M&A arrangements.

CFO Hub also offers a range of other financial planning services to help you accomplish your business goals. These include fractional controller services, audit and due diligence readiness, back-office support, HR, and DCAA compliance, among others.

It doesn’t publicly share pricing for any of its offerings, but you can expect it to be tailored to your unique engagement.

4. Indinero

Indinero is a financial management platform that offers fractional CFO services. While it works with businesses of all sizes, it specializes in certain types, including technology, professional services, non-profit, e-commerce, and healthcare companies.

Like CFO Hub, it organizes its fractional CFO advisory services into specific buckets. Here’s how they organize them:

Financial modeling: Create tailored financial models that support budgeting, forecasting, and long-term strategic planning

Business exit strategy: Develop customized exit plans that address company valuation, succession planning, and tax strategy

M&A transaction support: Guide you through M&A transactions, including due diligence, negotiation, and deal structuring

Fundraising support for startups: Prepare you for capital raises by creating financial models, forecasts, and pitch decks

Interim CFO guidance: Get short-term executive-level financial leadership during transitions, rapid growth, or restructuring

Investor relations: Maintain transparency with stakeholders through consistent communications and financial reporting

Similar to Zeni, Indinero also offers a variety of other financial services. These include bookkeeping, accounting, payroll management, business tax, and technology implementation support.

The platform only discloses pricing for its bookkeeping services, which start at $750 per month for relatively simple financial processes. For companies that need accrual accounting or are growing rapidly, the rate goes up to $1,250 per month.

5. Pilot

Pilot is a financial services provider that offers bookkeeping, tax, and fractional CFO support to startups and small businesses. It specializes in the professional services, consumer goods, healthcare, consulting, and artificial intelligence (AI) industries.

Pilot has a much more structured fractional CFO process than some of the others on this list. All engagements start with the CFO creating a financial model, helping them learn about your business and lay the foundation for additional planning.

You can expect to receive:

Financial statements

Scenario planning model

Budget vs. actual analysis

Industry-specific financial metrics

Headcount and compensation plans

After this initial onboarding, the CFO meets with you regularly for strategic financial planning, providing specific deliverables and services.

The Basic plan costs $2,000 per month when billed quarterly ($1,750 billed annually). You get one call with your CFO per month, during which the CFO will provide a financial model update, budget vs. actuals analysis update, and ad-hoc scenario planning.

The Essential plan costs $3,600 per month when billed quarterly ($3,150 billed annually). You get bi-weekly CFO calls plus cash and runway optimization, investor and board reporting, and basic fundraising and M&A support.

Custom Engagements start at $6,000 per month when billed quarterly ($5,250 billed annually). You get weekly CFO calls plus various potential add-ons, such as 13-week cashflow analysis, compensation benchmarking, and pricing strategy.

6. airCFO

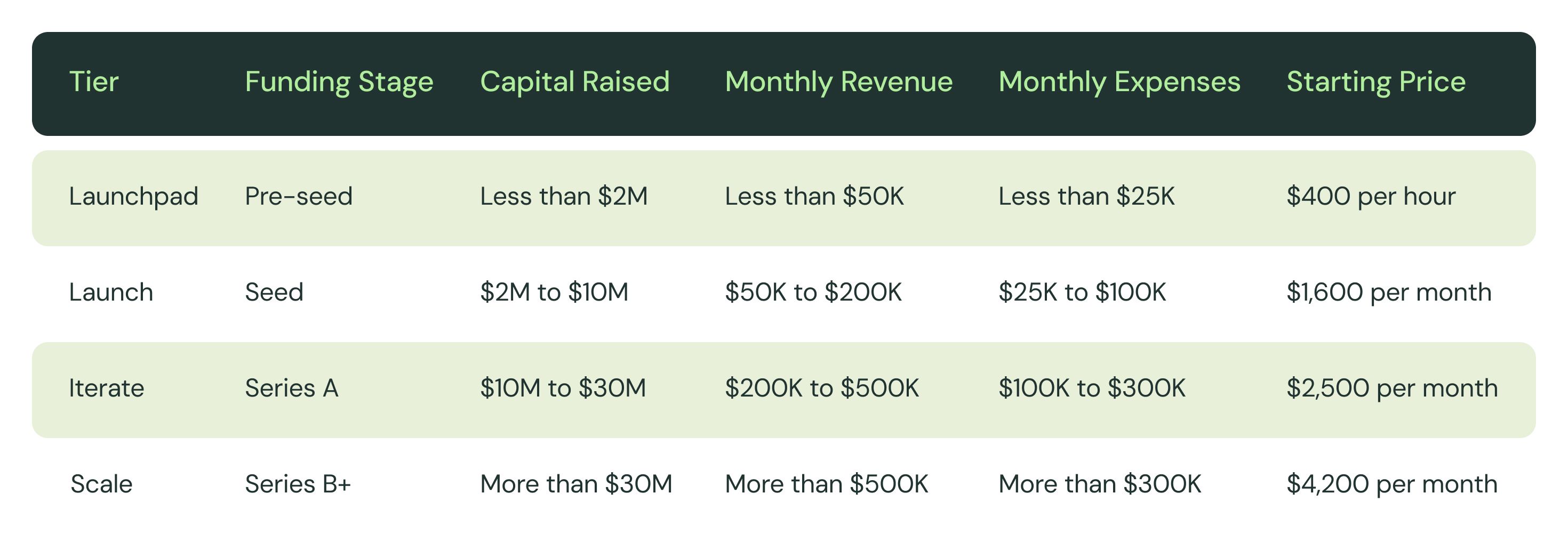

airCFO is a comprehensive back-office platform that offers accounting, business tax, HR, and finance services. It serves startups specifically, structuring its pricing around the startup funding stages. Here’s how that works for its finance services:

Here’s what you get at each tier:

Launchpad: The ability to consult with a fractional CFO for hourly support with one-off projects.

Launch: Eight hours of advisory and support, plus a monthly model update and executive summary.

Iterate: Twelve hours of advisory and support, plus a monthly model update and deep-dive analysis.

Scale: Twenty-one hours of advisory and support, plus a monthly model update and deep-dive analysis.

7. Paro

Instead of offering fractional CFO services directly, Paro is a marketplace that connects you with a financial professional from its talent pool. The platform uses AI to make sure you find the expert with the most relevant skills.

You can choose from a variety of talented fractional CFOs, including many with experience at Fortune 500 companies and the Big Four CPA firms. Paro’s CFOs have an average of 15 years of experience and all live in the United States.

While the pricing and details of your engagement will ultimately depend on what you work out with your provider, Paro states that its fractional CFO services include process consulting, business growth strategy, startup support, and transaction advisory.

The Bottom Line

Fractional CFO services are a flexible source of financial guidance, allowing you to benefit from C-level expertise without the cost of a full-time executive.

There are a lot of great options, with different ones rising to the top based on your needs. For example, Zeni is an excellent option for those who want ongoing support, and integrated products and service offerings. Other providers may be a better fit depending on your unique needs.